Is conducting a New Assessment for Home Luxury Tax in 2025 crucial?

Yes, in 2025, it must be performed, but what is the so-called “Home Luxury Tax?

The “HOME LUXURY TAX,” Impuesto Solidario para el Fortalecimiento de Programas de Vivienda (Law # 8683), was established in 2009 to fund nationwide social housing programs.

It is an annual tax on luxury residential properties exceeding a predetermined threshold, adjusted annually by the Tax office.

This tax is calculated based on a progressive rate system that considers the property’s construction value, which applies to houses, condos, or apartments and may differ from the property’s market value.

The entity or person obliged to file and pay the tax is the one that owns the ¨Luxury Home¨ as of January 1st of each year, including parties in a co-ownership or tenancy in common as well.

The real estate owner must determine the value of the main construction and the additional facilities (e.g., palapas, swimming pools, perimeter walls, internal streets, sports courts, etc.). The Manual of Unitary Base Values for Constructive Typology and tools are available for payors to assess the value to be declared for the luxury tax.

Once the value of the construction is determined, if it exceeds the threshold exempted amount established by the Tax Office for that year, you must calculate the value of the associated land as per the valuation parameters and then add it. The sum of these values will provide you with the total value of the property to be declared.

The Tax Office provides detailed information about the process to be followed, the yearly threshold amount exempt, and the tax bracket rates amount that apply each year.

Those that do qualify for this tax must:

Fill out the form: ‘Formulario Único de Inscripción, Declaración y Pago Impuesto Solidario para el Fortalecimiento de Programas de Vivienda’ (Law # 8683) every three years and pay the tax annually. The following assessment for the properties subject to the tax will be in 2025.

For 2025, the amount is ₡ 145.000.000,00 colones. This amount is adjusted each year by the Tax office.

The due date to pay the tax is January 15th of each year.

WHO IS RESPONSIBLE FOR PAYING THE TAX?

Buyers often wonder who is responsible and what their liability is if the seller did not pay the home luxury tax in the past.

The buyer is only jointly liable for the tax payment in the fiscal period when they are buying (according to section 7 of Law # 8683 and section 20 of the Regulation of the Solidarity Tax law). Therefore, the buyer would not be responsible for the previous years per the current rules and regulations:

“SECTION 7.- Affidavit

Taxpayers must submit, every three (3) years, from the effective date of this Law, within the first fifteen (15) calendar days of January of the corresponding fiscal period, a sworn statement that updates the value of the real estate, per the form and the conditions defined by the General Directorate of Taxation. Suppose the appraised value is greater than the value registered by the administration. In that case, the new declared value will automatically modify the applicable tax base for the fiscal period in which it is filed.

When the real estate object of this tax belongs to several co-owners, they must declare it jointly.

The owner of two or more adjoining and/or overlapping real estate must accumulate them in a single declaration for this tax, as long as their use coincides with those indicated in article 2 of this Law, and said assets form a housing use unit.

In the condominium property regime, the declaration of each condominium must include the corresponding proportional value for the common areas. In case of transfer of ownership of the real estate, the new owner will be jointly and severally liable for the tax payment of the fiscal period in force on the date of acquisition and the related interest. (The previous paragraph as amended by Article 3, section a) of Law No. 8981 of August 25th, 2011)”

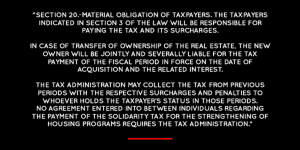

Also, the Regulation of the Solidarity Tax law states:

We advise hiring an appraiser, accountant, or person with expertise to help you with this diligence to avoid any penalties or fines for lack or improper filing.

We at GM Attorneys will be pleased to help you with legal matters in Costa Rica! You can contact us at info@gmattorneyscr.com or visit our website and blog section at https://gmattorneyscr.com/blog/