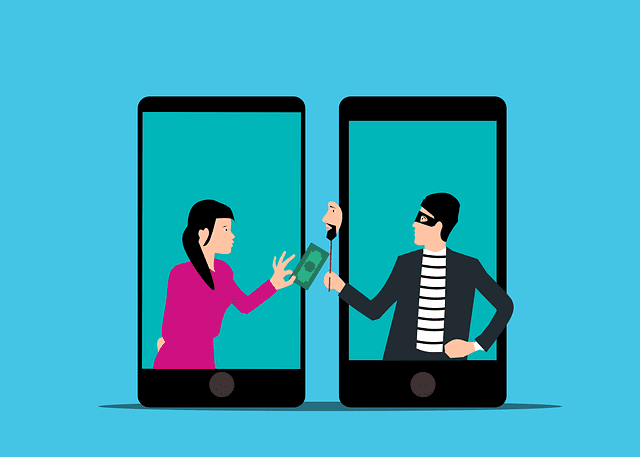

Learn To Recognize FAKE SINPE

QCOSTARICA — Every year 3.7 million transfers are made through the National Electronic Payment System, SINPE Movil, according to data from the Banco Central de Costa Rica (BCCR) – Central Bank.

Many opt for SINPE mobile transfers due to their convenience. However, its use is risk free. In the past year, the Organismo de Investigación Judicial (OIJ) documented 3,222 instances of fraud, with SINPE Móvil potentially playing a role in many of these incidents.

Recent cases involve the sending of fake SINPE payments, that is the receiver of a SINPE get confirmation of a payment made to their account, but upon contacting the bank, there is no record of a transaction or the information deleted and changed.

What is the easiest way to identify if a SINPE is fake?

Just look at the receipt number sent, the bank can use that information to determine if the transaction is fraudulent or not.

The first eight numbers of the receipt correspond to the year, day and month in which the transfer was made. The following three numbers are from the financial institution.

The Central Bank has a policy in which the banks must send a notification of each SINPE transaction in less than one minute. However, in real life practice, notifications may not always arrive immediately. There can be delays of several minutes or even until the next day.

Recommended is to check your bank account for confirmation of a transfer if there is suspicion of a fake SINPE before delivering a product or service. Bank apps can provide confirmation in less than a minute.

The Sistema Nacional de Pagos Electrónicos (SINPE) – National Electronic Payment System – is a technological platform developed and managed by the Central Bank of Costa Rica, which connects financial entities and public institutions in the country through a private telecommunications network, which allows them to carry out the mobilization electronic funds between IBAN accounts.

SINPE was launched on April 17, 1997.