Tighter Controls in Force – SUGEF Oversees More Economic Activities

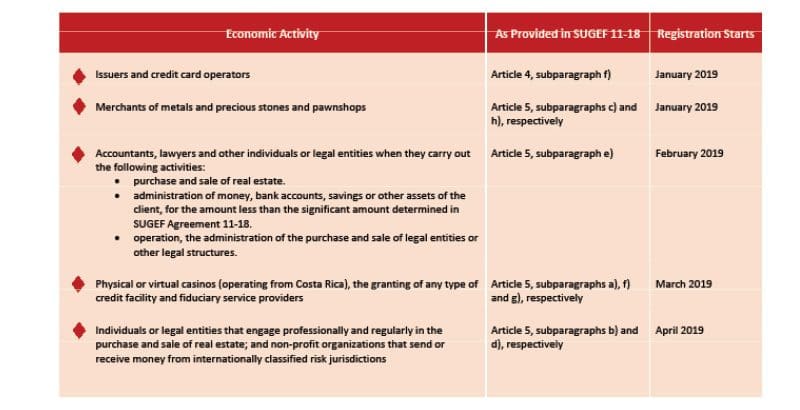

Tighter Controls in Force – SUGEF Oversees More Economic Activities. Stronger laws to combat money laundering and financing of terrorism in Costa Rica now apply to a wider range of economic activities that must be registered with the General Superintendence of Financial Institutions (SUGEF). A new regulation, SUGEF Agreement 11-18, was approved in October 2018 by the National Council for Financial System Supervision (CONASSIF) and became effective on January 1, 2019. The individuals and entities specified below become obligated to register their activities with SUGEF on the dates indicated.

These activities are described in Articles 15 and 15 bis of Costa Rica’s Law 7786, known as the “Drug, Money Laundering and Financing of Terrorism Law.” Modifications to the law in 2017 aimed to expand the range of individuals or entities subject to CONASSIF supervision. Calls for similar “gatekeeper legislation” around the world had become more strenuous from the international Financial Action Task Force (FATF).

Law 7786 previously applied

only to financial institutions

and entities that managed third-party funds.

Costa Rica’s law 7786 previously applied only to financial institutions and entities that managed third-party funds. The new law extends to Designated Non-Financial Activities and Professions (DNFBs), relating to the FATF’s evaluation of Costa Rica in 2015. Article 15 bis of Law 7786 stipulates which individuals and legal entities involved with DNFBPs must submit to SUGEF registration and supervision by SUGEF, including:

Trust administrators or any kind of money management structure

Intermediaries, owners or builders in the real estate business in a habitual manner

Dealers of precious metals and stones

Lawyers, notaries, accountants and any others carrying out the following on behalf of clients:

Purchase or sale of real estate

Money management

Although the same legislation applies to Notary Publics, they are excluded from SUGEF supervision. Instead, they will be supervised by a specialized unit of Dirección Nacional de Notarios (General Directorate of Notaries).

Failure to comply with the new SUGEF regulation carries the risk of severe administrative and economic sanctions and significant reputational consequences.

For more information about the SUGEF registration requirements and other aspects, contact your lawyer or email us at info@gmattorneyscr.com.

HOA Meetings

Tax Time, Corporations and Property Owners

Corporate Tax Update

Power of Attorney in Costa Rica

Annual Tax Over Costa Rica Corporations

Due Diligence, Purchasing a Vehicle in Costa Rica

Costa Rica Income and Sales Tax

Estate Planning

Purchasing a Condominium in Costa Rica

Buying a Business in Costa Rica

Applying for Cost Rica Residency

Corporate Alert

Set Up a Corporation in Costa Rica