Costa Rica Electronic Invoicing Mandatory for Property Rentals: Legal Ease

Costa Rica Electronic Invoicing Mandatory for Property Rentals – Legal Ease: Real estate rentals will soon be subject to the same legal requirement for electronic invoicing (factura electronica) as all other taxpayers in Costa Rica.

As discussed in Howler’s July 2018 LegalEase article, the transition to a mandatory electronic invoicing system for taxpayers got underway earlier this year. Under a 2018 schedule of phased-in compliance deadlines, Resolution No. DGT-R-51-2016 stipulated which types of businesses and professional service providers would be required to use electronic billing and receipts for all customer/client transactions.

Corporate ownership of a property

can be beneficial for estate and tax planning.

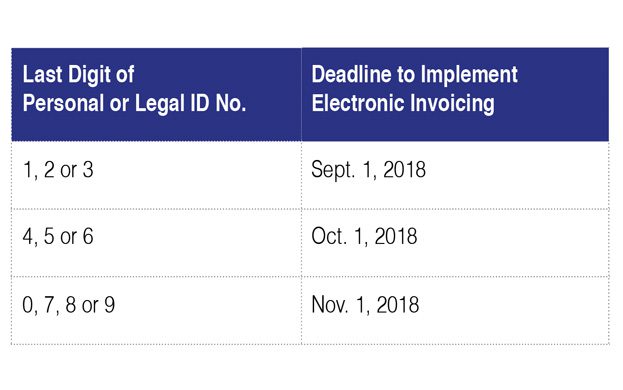

The same obligation to adopt mandatory electronic invoicing has since been extended to other taxpayers not mandated previously, including landlords of rental properties. Under Article 3, Resolution No. DGT-R-012-2018, the tax office issued implementation deadlines according to the last digit of identification numbers, either personal (dimex or cédula de indentidad) or corporate (cédula juridica). Effective on the dates indicated, landlords must provide tenants with a proper electronic invoice for all rent payments. This includes any type of rentals: short or long-term, residential or commercial, and vacation.

Effective on the dates indicated, landlords must provide tenants with a proper electronic invoice for all rent payments. This includes any type of rentals: short or long-term, residential or commercial, and vacation.

Keep in mind that vacation property rentals (houses, apartments and condominiums) for periods of less than one month are subject to both income and sales/value-added (vat) taxes. Therefore, those who perform such activity must register as taxpayers and comply with the payments, in order to avoid fines and penalties.

Costa Rica’s mandatory electronic invoicing requirement is an outcome of 2016 legislation “to improve the fight against tax fraud.” Failure to comply is also subject to fines and penalties.

A variety of electronic billing service packages are offered by more than 10 authorized providers in Costa Rica. Taxpayers are free to choose one that best suits their needs. You may also qualify to use the free system offered by the tax office.

Currently, Costa Rica abides by a “limited territoriality” concept of taxation. That means only income derived from a Costa Rican source is taxed. However, caution is advised concerning the interpretation of “Costa Rican source” by tax office and court officials. Seeking proper legal and accounting advice is strongly recommended in view of a proposed new tax law under discussion. If implemented, new taxes or modifications may apply to activities that are currently not taxable.

For more information visit the Ministerio de Hacienda Costa Rica

Need a reputable lawyer in Costa Rica

Contact: GM Attorneys at Law

Tell them you learned about them from Howler Magazine

HOA Meetings

Tax Time, Corporations and Property Owners

Corporate Tax Update

Power of Attorney in Costa Rica

Annual Tax Over Costa Rica Corporations

Due Diligence, Purchasing a Vehicle in Costa Rica

Costa Rica Income and Sales Tax

Estate Planning

Purchasing a Condominium in Costa Rica

Buying a Business in Costa Rica

Applying for Cost Rica Residency

Corporate Alert

Set Up a Corporation in Costa Rica