If you’ve lived in or visited Costa Rica for more than a week, you’ve probably heard someone mutter, “El dólar está flojo.” For years, the greenback felt like a super-currency here. Now, with the colón hovering around ₡500 per US$1 and having been much stronger than that compared with the ¢660–700 range of mid-2022, the story has changed.(tourismanalytics.com)

This isn’t just a nerdy FX chart problem. A stronger colón versus a wobblier dollar affects what tourists pay, what workers earn, how businesses survive – and even how you should pull out your wallet.

What’s actually happening with the dollar and the colón?

Right now the rate sits roughly around ₡495–₡505 per dollar, with an average in 2025 of about ₡504.(Trading Economics) That’s a much stronger colón than a few years ago, when you could easily see rates around ₡650–700 per dollar.(tourismanalytics.com)

Why has the colón flexed so much muscle?

- Costa Rica has enjoyed solid economic growth and improved macro fundamentals.(OECD)

- Interest rates here have often been higher than in the US, making colón-denominated assets more attractive.(OECD)

- Stronger services exports – tourism, medical devices, digital services – have brought in plenty of foreign currency.(OECD)

All of that has pulled the exchange rate down toward ₡500, and recently Costa Rica’s tourism chamber has been sounding the alarm: a “super-colón” makes the country more expensive for visitors and squeezes businesses that earn in dollars but pay most costs in colones.(Central America)

What does this mean for tourism, jobs and travel?

For tourists:

If your income is in dollars or euros, Costa Rica now feels pricier than some regional competitors like Colombia or the Dominican Republic.(tourismanalytics.com) Hotels, tours and restaurants that haven’t adjusted prices can suddenly look steep when your home currency buys fewer colones. That can:

- Push budget travellers toward cheaper destinations.

- Shorten stays or shrink spending per visitor.

For tourism businesses and employment:

Most tourism operators pay wages, utilities, fuel and supplies in colones, but they collect a big chunk of income in dollars. When the colón strengthens:

- Every dollar of revenue converts to fewer colones.

- Payroll and local bills don’t magically go down.

- Margins compress – so owners raise prices, cut staff or delay investment.(Central America)

That’s why you hear talk of layoffs and “tourism crises” tied to the exchange rate, not just global demand.(tourismanalytics.com)

For Costa Ricans in general:

A stronger colón can help with imported inflation – things like fuel or electronics may be cheaper in local currency than they would be with a weak colón. But export-oriented sectors (including tourism) suffer, which can hit employment in coastal and rural areas hardest.

And globally – is the dollar really dying?

Zooming out, the US dollar is weaker against some currencies and has had a rough ride recently, but it is still the backbone of global finance.

- Around 56–58% of disclosed global foreign exchange reserves are still held in dollars – down from over 70% in 2000, but far ahead of the euro (~20%) and everyone else.(Federal Reserve)

- Most commodities are priced in dollars, and a huge share of world trade and international debt is still dollar-denominated.(Federal Reserve)

Central banks are diversifying on the margins, and political drama plus tariff wars haven’t helped confidence in the greenback.(The Guardian) But there is no single rival ready to replace it tomorrow. So: locally, the dollar feels weak versus the colón; globally, it’s bruised but still boss.

Practically speaking: how should you pay in Costa Rica?

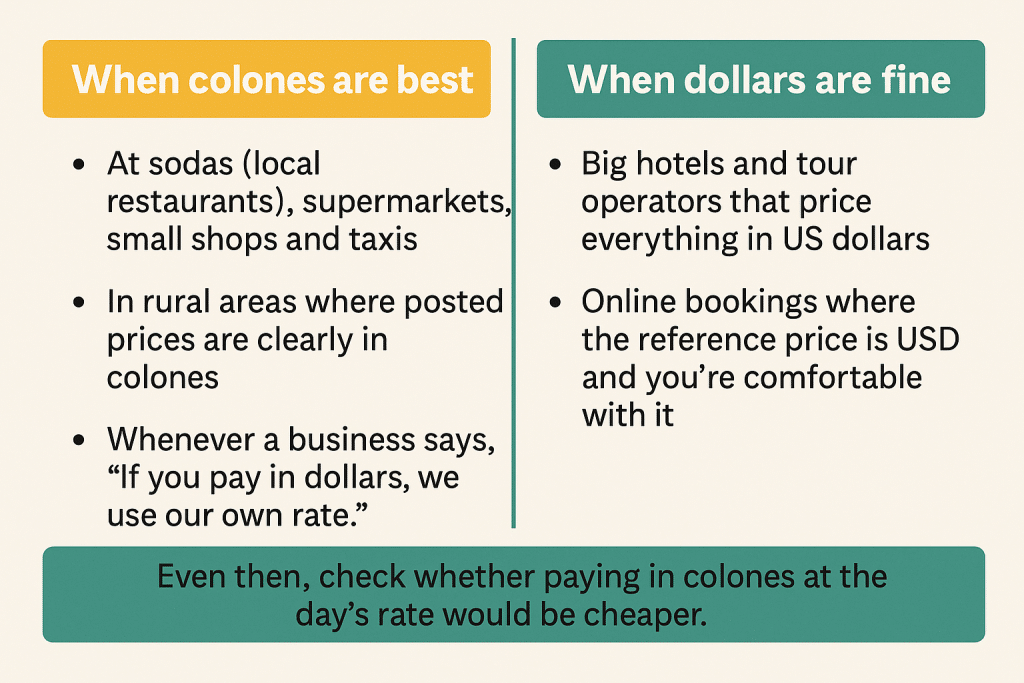

1. Colones vs dollars

When are colones best

- At sodas (local restaurants), supermarkets, small shops and taxis.

- In rural areas, where posted prices are clearly in colones.

- Whenever a business says, “If you pay in dollars, we use our own rate.”

If the official rate is ~₡500 per US$1 but a store gives you ₡470, you’re losing about 6% instantly. That’s “tourist tax” by exchange rate.

When dollars are fine

- Big hotels and tour operators that price everything in US dollars.

- Online bookings where the reference price is USD and you’re comfortable with it.

Even then, check whether paying in colones at the day’s rate would be cheaper.

2. Credit card strategy (and which currency to choose)

General rule:

Use a credit card with no foreign transaction fees and always pay in local currency (CRC) at the terminal.

Here’s why:

- Most Costa Rican card terminals offer Dynamic Currency Conversion (DCC) – “Do you want to pay in USD/EUR instead of CRC?”

- If you pick your home currency, the local bank chooses the rate, often adding 3–8% on top of your card issuer’s normal rate.

- If you choose CRC, your own bank does the conversion at or near the interbank rate, plus whatever FX fee your card normally charges.

So:

- On the machine: pick colones (CRC).

- On your statement: your card will show the charge in your home currency (USD, EUR, GBP, etc.) automatically.

Use ATMs from major banks (BNCR, BCR, BAC, etc.), not random kiosks in tourist strips. Those off-brand machines often layer ugly fees and terrible rates on top.

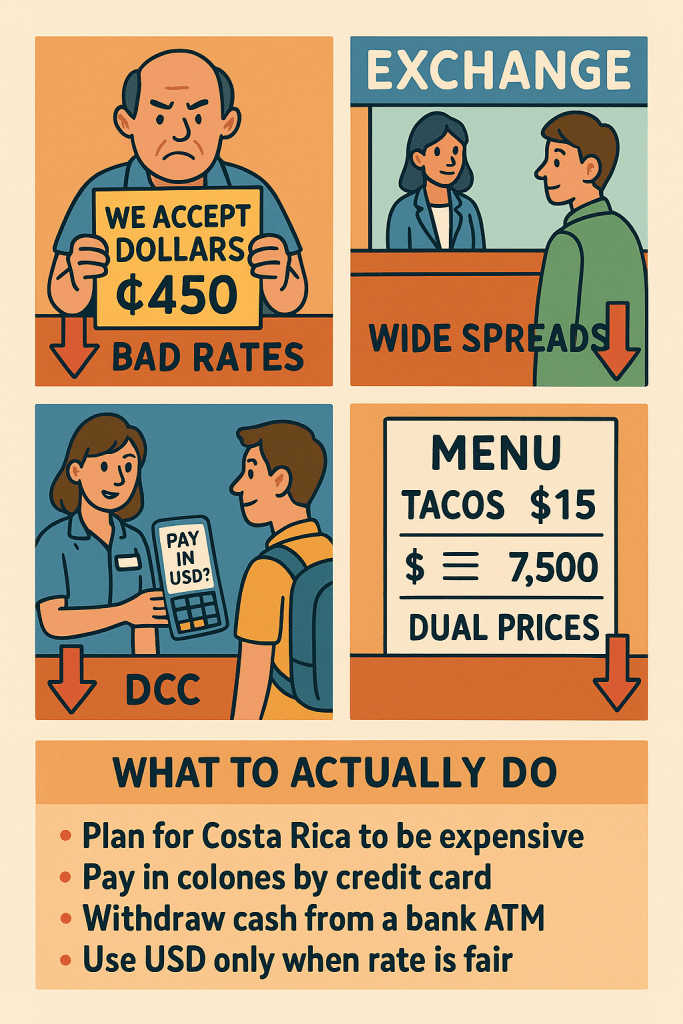

Common exchange-rate tricks and traps

Watch for:

- Bad shop rates: “We accept dollars” – then they convert at a rate far from the official one, and give change in colones at that same bad rate.

- Airport and hotel exchange counters: convenient, but spreads can be very wide. Treat them as last resort.

- Dynamic Currency Conversion (DCC): the smiling offer to charge your card in USD or EUR “for your convenience.” It’s almost never to your advantage.

- Dual-price menus: sometimes prices are listed in both USD and CRC, but the implied rate is off. A quick mental check will tell you if you’re being overcharged.

So what should you actually do?

For tourists and short-term visitors:

- Plan for Costa Rica to be on the expensive side of Latin America while the colón is strong.(tourismanalytics.com)

- Bring a solid credit card with no (or low) foreign fees and pay in CRC at the terminal.

- Withdraw a modest amount of colones from a bank ATM for tips, taxis and small cash purchases.

- Use USD cash only where prices are clearly set in dollars and the rate is fair.

For expats and long-stay residents:

- Think in terms of matching your currency to your costs. If your rent, groceries and school fees are in colones, it makes sense to hold a decent chunk of your cash in colones.

- If you have obligations in dollars (US mortgage, student loans, income in USD), keep some reserves in dollars too.

- Don’t obsess over day-to-day wiggles; focus on the big bands (e.g., is the rate closer to 500 or 650?) and plan accordingly.

The dollar may be wobbling on the world stage and on Costa Rican rate boards, but for now it’s still very much the reference currency. The smart move is not to panic – it’s to understand the game, choose your payment methods wisely, and avoid handing away extra percentage points in hidden FX “tips” you never meant to leave.