Costa Rica Tax Fraud Prevention Update: Legal Ease

- JUL 04, 2018Warning: count(): Parameter must be an array or an object that implements Countable in /home/howlermag/public_html/old/wp-content/themes/new-paper/includes/general.php on line 193

Your Lead Paragrpah goes here

Costa Rica Tax Fraud Prevention Update: Legal Ease: The following are outcomes of 2016 legislation “to improve the fight against tax fraud” in Costa Rica.

Mandatory electronic invoicing

The transition to a mandatory electronic invoicing system (factura electronica) for taxpayers got underway earlier this year. Under a 2018 schedule of phased-in compliance deadlines, Resolution No. DGT-R-51-2016 stipulated which types of businesses and professional service providers would be required to use electronic billing and receipts for all customer/client transactions. Those sectors include health, accounting, legal, engineering, architecture, computer science, geology, geography, biology and advertising.

All legal entities and corporations

must provide information about

their shareholders and “beneficial owners.”

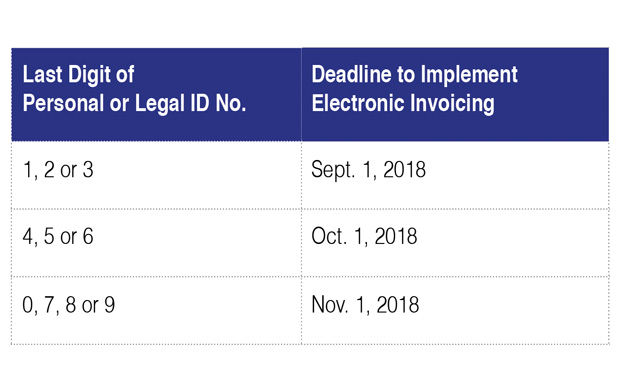

The same obligation to adopt mandatory electronic invoicing has since been extended to taxpayers who were not included in the DGT-R-51-2016 mandate. On March 20, 2018, the tax office issued implementation deadlines as follows under Article 3, Resolution No. DGT-R-012-2018.

Failure to comply with the mandatory electronic invoicing requirement is subject to severe penalties and fines.

A variety of electronic billing service packages are offered by more than 10 authorized providers in Costa Rica. Taxpayers are free to choose one that best suits their personal or business needs. You may also qualify to use the free system offered by the tax office.

Shareholders registry

Executive Decree No. 41040-H, dated Apr. 5, 2018, establishes a mechanism for the mandatory disclosure of corporate shareholder information. The Central Bank of Costa Rica (BCCR) is charged with creating and operating a shareholder registry database platform to be implemented by June 30, 2018.

All legal entities and corporations in Costa Rica must provide information about their shareholders and “beneficial owners” who have substantive participation — between 15 and 25 percent of the total share capital. The same requirement applies to trusts, except for public trusts, third-party asset managers and nonprofit organizations. However, there is no obligation to disclose customer information for financial entities supervised by the General Superintendency of Financial Institutions (SUGEF) or General Superintendence of Securities (SUGEVAL). Also exempt are publicly traded companies listed on organized stock exchanges, either locally or internationally, as they are subject to specific stock market rules and regulations.

For details, visit the Attorney General of Costa Rica website and view Executive Decree No. 41040-H.

New agreement for exchanging

tax information

Costa Rica and the United States allow for the exchange of information relevant to the determination, liquidation and collection of taxes, execution of tax claims, or the investigation or prosecution of tax cases.

Signed on Apr. 23, 2018, this agreement must be ratified by Costa Rica’s Asamblea Legislativa and published in the legal newspaper La Gaceta.

Other HOWLER Legal Ease articles

HOA Meetings

Tax Time, Corporations and Property Owners

Corporate Tax Update

Power of Attorney in Costa Rica

Annual Tax Over Costa Rica Corporations

Due Diligence, Purchasing a Vehicle in Costa Rica

Costa Rica Income and Sales Tax

Estate Planning

Purchasing a Condominium in Costa Rica

Buying a Business in Costa Rica

Applying for Cost Rica Residency

Corporate Alert

Set Up a Corporation in Costa Rica