Set Up a Corporation in Costa Rica

- JUN 02, 2018Warning: count(): Parameter must be an array or an object that implements Countable in /home/howlermag/public_html/old/wp-content/themes/new-paper/includes/general.php on line 193

Your Lead Paragrpah goes here

Set Up a Corporation in Costa Rica: Understanding the advantages of setting up a corporation in Costa Rica is important when contemplating the relatively unrestricted opportunities for foreign business or property owners. Purchasing property through a Costa Rican corporation, for example, may not be a requirement in some circumstances, but it’s still advisable in the interest of flexibility and liability protection. Furthermore, corporate ownership of a property allows for proper estate and tax planning, and enables property owners to grant a special power of attorney to act in their absence.

Seek advice from a trusted

Costa Rica attorney beforehand.

The two primary types of corporate entities in Costa Rica are Sociedad Anónima (SA) and Sociedad de Responsabilidad Limitada (SRL). In both cases, liability is limited to the corporation’́s assets and totality of shareholder or quota holder contributions. Therefore, personal assets are protected against any of the company’s potential creditors.

Other Howler Costa Rica Legal Ease Articles

Applying for Costa Rica Residency

HOA Meetings

Tax Time, Corporations and Property Owners

Corporate Tax Update

Power of Attorney in Costa Rica

Annual Tax Over Costa Rica Corporations

Due Diligence, Purchasing a Vehicle in Costa Rica

Costa Rica Income & Sales Tax

Estate Planning

Purchasing a Condominium

Buying a Business

Set up a corporation in Costa Rica has Notable differences between the two types of corporations include the following.

The SA is governed by a board of directors comprising at least four individuals. In addition to a president, secretary and treasurer, the comptroller position is mandatory. Each appointment must be occupied by a different person of legal age. The capital stocks of an SA corporation are called shares. They can be transferred through endorsement of the share certificates and proper entry in the shareholder registry. Shareholders may transfer their interest to a third party freely unless otherwise stated in the SA articles of incorporation or bylaws.

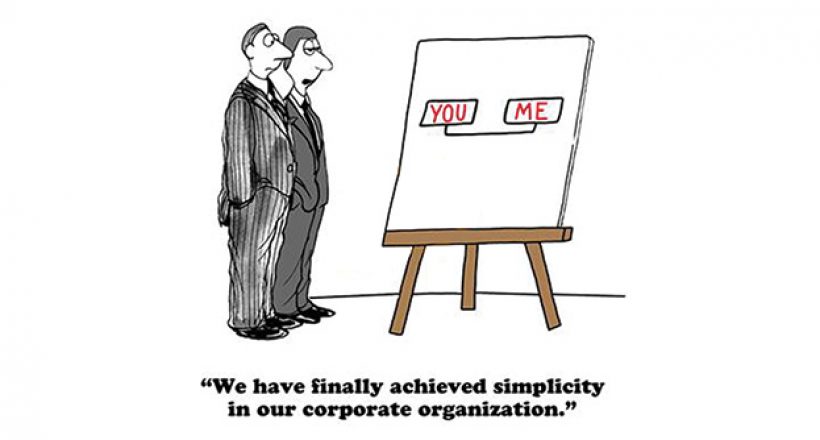

The SRL does not have a board of directors. Therefore, it could be governed by only one individual (manager), making it relatively easy and simple. The capital stocks of an SRL corporation are called quotas. They are transferred through an assignment agreement and proper entry in the quota holder registry book. However, quota holders have a right of first refusal provision for the sale of quotas. Therefore, quotas cannot be transferred to a third party without offering their interest to the other quota holders first.

Anyone planning to set up a corporation here is urged to seek advice from a trusted Costa Rica attorney beforehand. This legal expertise will help determine the most appropriate corporate structure required for the business or investment you want to make. It must be successfully implemented to avoid problems with the authorities in Costa Rica and for your corporation to operate smoothly.