What You Eat Has The Power of What You Can Achieve

Paying More Attention to the Way You Eat Can Help Your Productivity

The truth is that we have created our own diet by the way we eat.

Hello, my fellow wellness-prenuers! It is unbelievable how time flies; it is October, and most of us are looking forward to having a unique costume for the end of the month. Well, it will give us 31 days to find the best costume, and to get a better understanding of how you eat.

I chose this topic because after October, we have Thanksgiving and Christmas holidays. I want to give you a way to keep good healthy eating habits, which can help you stay focused and keep the energy to continue a dynamic work routine.

Why it’s essential to know what we eat

Food is our energy, our fuel. Food gives us the necessary sources to maintain proper body and mind functioning.

So, knowing what you eat will give you the knowledge of what food works better for you than others.

Let´s review: What are the components of any food?

Macronutrients: they give metabolic energy and sources to the body. There are three types:

Proteins are amino acids, our building blocks for body tissue that keep us strong

Carbohydrates give you energy.

Fats (the good ones) help to produce, regenerate and maintain the optimal body and brain function and cells.

Micronutrients: these are vitamins and minerals, which are very important because they are largely involved in the chemical process that has to do with your metabolism.

Now that you know how food is composed, we are going to talk about the best sources and the worst ones.

When I was in my Integrative Nutrition Health Coach training, I received a master’s class from a doctor who demonstrated that we can heal ourselves through a good nutritional diet. Dr. Joel Fuhrman dedicated his work to showing us that we can heal and reverse diseases with a proper diet.

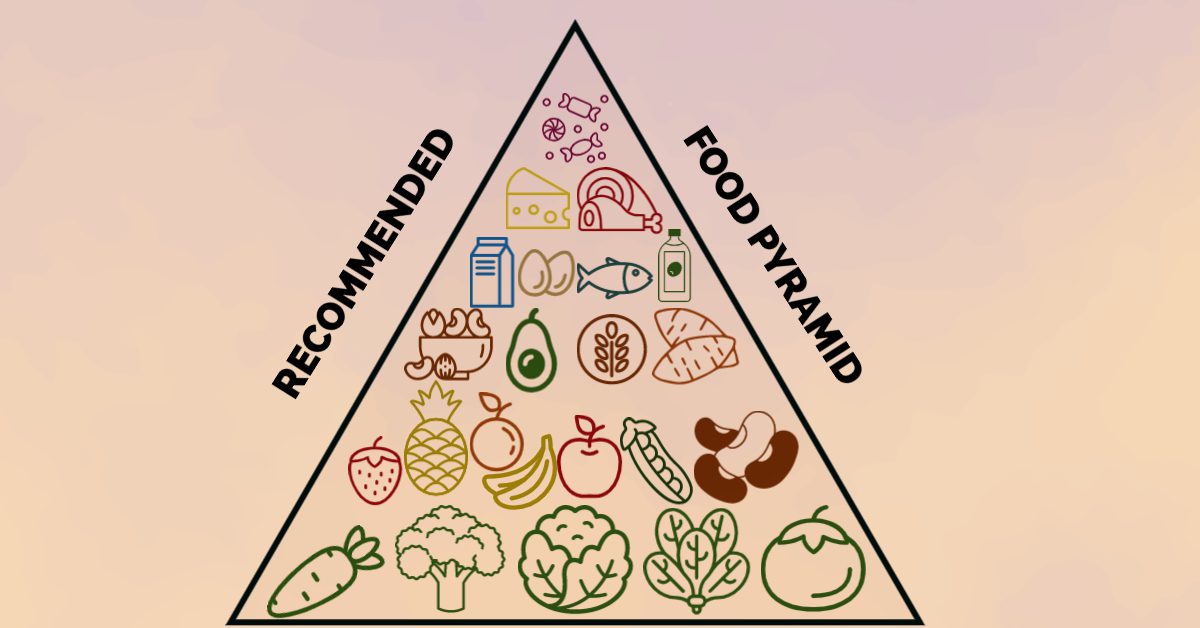

Nutritional Food Pyramid

I love Dr. Fuhrman’s Nutritional Food Pyramid. At the base of the pyramid, he added leafy greens and vegetables. Above that are fruits and legumes. Then, in smaller quantities, come whole grains, seeds, avocados, potatoes, and nuts. At the pyramid´s peak, you will find fats, milk, cheese, yogurt, eggs, meat, and sweet and processed food.

So, if this pyramid shows the optimal amount of a type of food that we should eat to have balanced nutrition that contributes to our wellness, it can give us a guide to keep us working in the best way.

Do you know that your diet is unique? People get confused with the word “diet” and believe it refers to a specific named diet. The truth is that we have created our own diet by the way we eat.

Homework assignment

So, I will give you some homework. See how your diet is composed. Take, for instance, Dr. Fuhrman’s Nutritional Food Pyramid and create your own pyramid. Then compare both pyramids with each other. If you are interested in improving your energy, focus, and productivity, think about three things that you can change in your pyramid to make it more balanced like Dr. Fuhrman’s pyramid. Your pyramid doesn´t have to be exactly like his, but take into consideration that Dr. Fuhrman’s Nutritional Food Pyramid works for body and mind wellness.

Keep up the good work!!!

https://www.instagram.com/movimientosattva/

Do you want to know more about Dr. Fuhrman?

Click this link: Joel Fuhrman, M.D. – Biography | DrFuhrman.com